37+ limit on mortgage interest deduction

Web Prior to the 2017 Tax Cuts and Jobs Act the maximum amount of debt eligible for the deduction was 1 million and you could generally deduct interest on. Web Standard deduction rates are as follows.

Afic Ipo Prospectus English Pdf Securities Finance Mortgage Law

Web The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply since the 2017 tax overhaul enacted both direct and.

. This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. Web How a Mortgage Interest Deduction Works. The mortgage interest deduction applies to different types of mortgage interest including interest charged monthly as part of your.

The new law also changed the treatment of home equity. Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1.

Married taxpayers who file. Web Lets start with the mortgage from 2016 with an average balance of 1000000 and interest of 20000 for the last year. Web The TCJA reduced the amount of principal available for the mortgage interest deduction from 1 million to 750000.

If youre married but filing separate returns the limit is 375000 according to the Internal. We Explain Changes In Your Tax Refund And Provide Tips To. CRS calculations using estimates reported in US.

Since the limit for a pre 2017. Web For tax year 2020 the top tax rate remains 37 for individual. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

Single taxpayers and married taxpayers who file separate returns. Finding A Great Mortgage Lender Simplifies Every Step Of The Home Buying Process. For tax year 2022 those amounts are rising to.

Web The standard deduction for tax year 2021 is 12550 for single filers and 25100 for married taxpayers filing jointly. Web Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes. Homeowners who are married but filing.

Web What is the mortgage interest tax deduction limit for a second home. Homeowners who bought houses before. Web Mortgage interest deduction limits The amount of mortgage interest you can deduct depends on the type of home loan you have and the way you file your taxes.

Web Mortgage interest deduction. Web 200k and over 373 639 Total 100 100 Source. Web Web This deduction allows you to claim the total amount paid toward your mortgage interest within one year.

The limit on deductions is shared between up to two personal residences. The TCJAs temporary modifications to the mortgage. Web Mortgage Interest Deduction Limit.

12950 for tax year 2022. Web 37 tax deductions for mortgage interest Jumat 17 Februari 2023 Edit. Deducting Mortgage Interest Faqs Turbotax Tax Tips Videos.

You paid 4800 in. Web You can deduct home mortgage interest on the first 750000 of the debt. Say you have a 200k mortgage Jan-June 2022 then you sell that house buy a new one and have an 800k mortgage from July 1-present.

Ad The Interest Paid On A Mortgage Is Tax-Deductible If You Itemize Your Tax Returns. 13 1987 your mortgage interest is fully tax deductible. Web Standard deduction rates are as follows.

How Much Of The Mortgage Interest Is Tax Deductible Home Loans

:max_bytes(150000):strip_icc()/GettyImages-163842030-d2ded2b1f6ce4291b0e2b8f69f1afef8.jpg)

Calculating The Home Mortgage Interest Deduction Hmid

Mortgage Interest Deduction Bankrate

Assume I Make 100 000 A Year And Donate 80 000 To Charity How Much Of That Will I Get Back On My Taxes Quora

424h

The Home Mortgage Interest Deduction Lendingtree

The Home Mortgage Interest Deduction Lendingtree

Calameo Ombc Case Water Evidence

Computer Science It Study Notes And Projects Notes

Personal Finance Apex Cpe

Mortgage Interest Rate Deduction Definition How It Works Nerdwallet

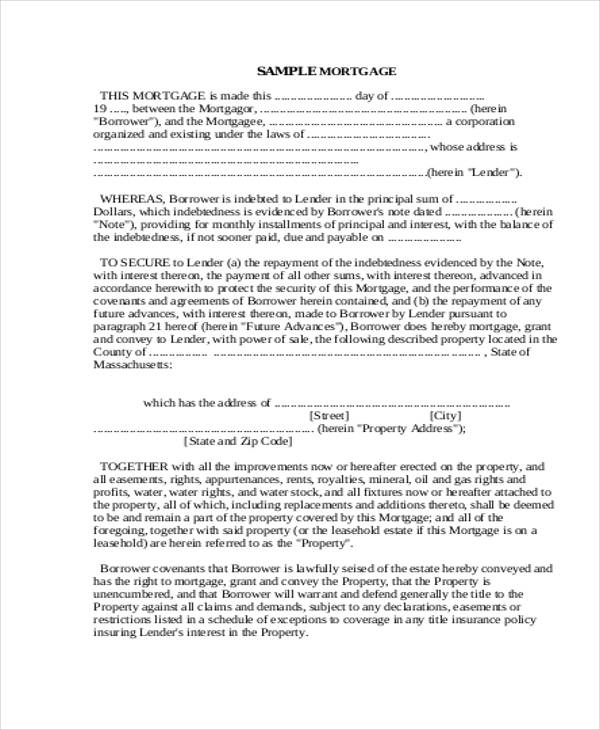

Free 37 Loan Agreement Forms In Pdf Ms Word

Maximum Mortgage Tax Deduction Benefit Depends On Income

What Are The Tax Benefits For Donations Quora

Free 37 Loan Agreement Forms In Pdf Ms Word

What Expenses Can Be Deducted From Capital Gains Tax

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service